Is RWA a product or a transaction?

scanning:551

author:

time:2024-09-10

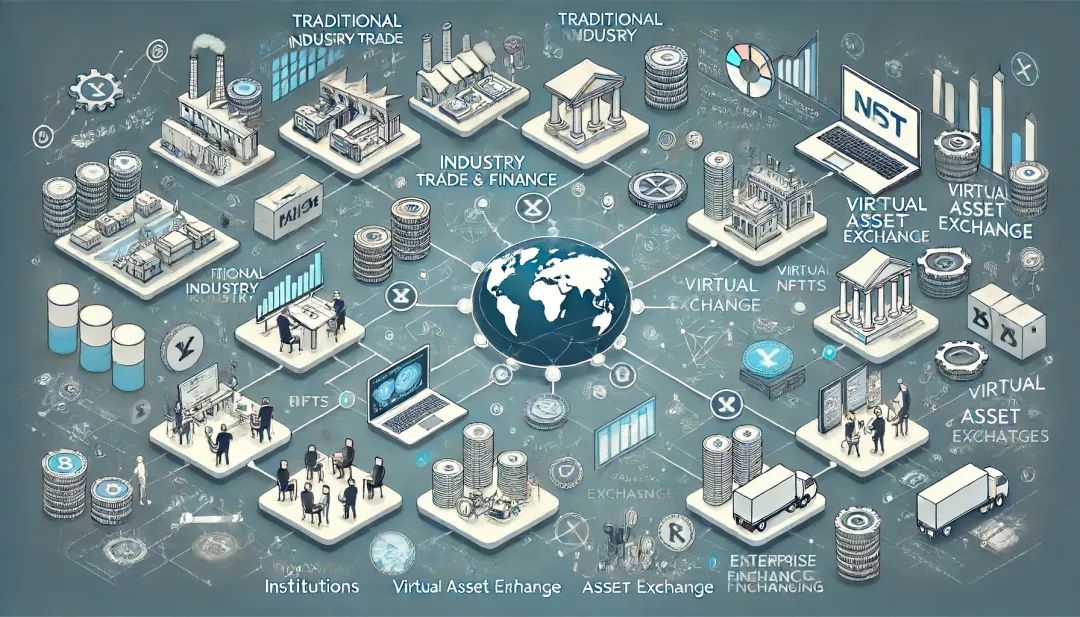

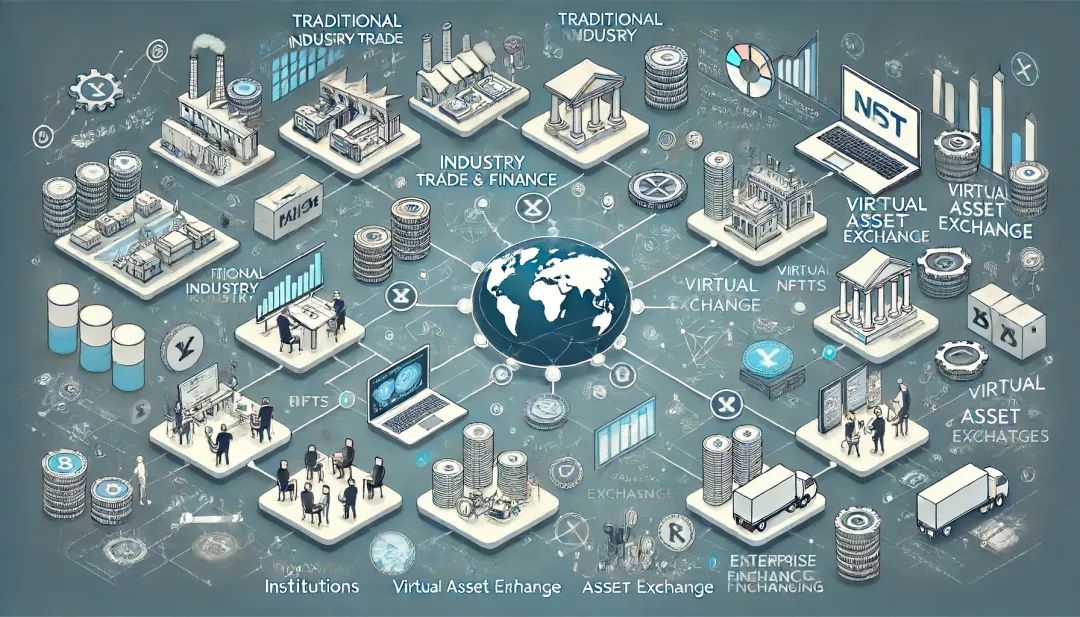

What exactly is?RWA(real world asset monetization)?Encryption fundamentalism pops up to say that RWA should not be so tacky. We have said before that the premise of RWA discussion is that RWA is a pragmatic and moderate compromise between traditional finance and Crypto.Many people say that the concept of RWA is too empty, real-world assets are monetized, everything is packed into RWA, but there is no real RWA.This question should be followed up in terms of words:Is RWA a product or a transaction??If it is a product, then RWA is similar to bitcoin spot.ETFOr T-Bill products of interest-bearing assets secured by US debt?If it's a deal, then it's a deal for RWA products? Or is it the same encrypted trading of financial assets as TradFi's financial assets exchange?If combined with the core nature of RWA that we have always emphasized is corporate financing and institutional market. The product is similar to a corporate bond product, trading is similar to financial asset trading, and revolves around the asset package of corporate financing and the institutional market ecology of the product.Compared with specific cases, such as bitcoin spot ETF, tokenized base, RWA stable coins, etc., basically are product direction, not corporate financing, while those monetized corporate bonds, fixed collection bonds and digital REITs (tokenized cash distribution) are corporate financing.

Why discuss the different perspectives of products and transactions?The former is more Web3.0 in terms of products, while the latter is more RWA in terms of transaction. Why would you say that?ProductFrom the perspective of retail investors, especially Web3.0 investors, who are used to investing in a certain token, there are already a lot of encrypted token projects with the concept of RWA. At the same time, products tend to be standardized, focusing more on product design, TGE issuance and so on. Whether it is the T-Bill or RWA concept token of interest-bearing assets of US debt, or DePIN and AI participate in the concept narrative as infrastructure, it is the routine and ecology of standardized products.TradeFrom an institutional point of view, financial asset trading, mostly corporate financing and institutional investment, is a non-standardized product trading ecology. Although the subject matter of the transaction will be designed as a financing product, asset trading and issuance is only the first step of under the table, followed by the inter-bank market, OTC bond market and inter-agency margin trading.Reverse repurchaseAnd equity payment, and so on, sometimes there will be a local market for retail investment.From the perspective of Crypto, it is more like an industrial transaction triggered by corporate financing and the digitization and encryption of upstream and downstream channels.So it's a bit like nonsense: RWA is not like a product, it's a model but not a model. Real-world asset monetization is a transfer from traditional financial investment and financing to virtual assets and monetized world, while the old money and users attracted by real-world assets means that RWA is either in the form of real-world assets that old money can understand, or a new form supported by real-world assets.RWA model of integration of products and transactionsThe integration of the old and the new may be the compromise and moderation in the initial stage of RWA.Traditional debt (RA) are institutional clients, block transactions andOver-the-counter marketWhile the Web3.0 Exchange mainly focuses on retail customers, loose (leek) households (vegetables).If the RWA of integrated products and transactions may solve this: based on RWA products (US debt ETF, Bitcoin ETF and other high-quality assets), iterate through new earnings or arbitrage tokens (or agreements), a multi-level trading market for primary and secondary arbitrage, and further expand RWA-based pledge financing, interest rate swaps and other RWA derivative tokens.This integration model can be aimed at both institutional customers and retail investors.At present, the RWA projects produced by Hong Kong's licensed compliance are basically either real estate debt collection or corporate credit debt in the initial stage, and then set up a monetized shell, which can be regarded as the most basic simple product.In fact, the complex products of real-world assets are combined with the industrial transactions of real-world assets.Industrial financeCombined with capital, asset monetization is not only a monetization of a real-world asset, but also an asset associated with it.Industrial chain and capital chainTokenization.Looking at RWA from this point of view, there may be several directions:1)Enterprise financingDirection, mostly in the form of RWA products, around corporate financing of digital debt, digital REITs and other products, the design may be diversified, one is credit debt, one is income rights, the other is cash flow and other different design patterns.2)Industrial transactionThe direction will highlight the business design of the RWA exchange, how to combine trade and flow to realize the tokenization of spot transactions and arbitrage, gradually transfer the tokens pricing power and Crypto leverage of real-world assets, replace the inter-bank business to the OTC exchange market and mortgage agreements, etc., design the flow pool and draw lessons from the airdrop and mining models to develop the Crypto Fund primary and secondary linkage of digital investment banking business. The key is to attract and realize the linkage between the upstream and downstream of the industry.3)Investment and FinanceThe direction is to design RWA investment wealth management products, either Crypto fixed income products, or arbitrage, or priority and inferiority and TRS, or income yield Token, to replace traditional financial investment products, centering on the demand for the exchange of capital costs and interest rates of global funds and institutions.4)Original tokenThe direction is to focus on the tokenization of emerging assets that cannot be valued by traditional finance, such as renewable energy and AI computing power, especially the combination of renewable energy with DePIN and VPP (virtual grid), to realize P2P transactions and green energy stablecoins for renewable energy. This will be a huge market opportunity, because in May this year, G7 member states jointly committed to phase out the existing and increasing coal-fired power generation in the energy system in the first half of 2035.How to realize the transformation of the 2B market into the 2C market?Since the traditional corporate bond market is a 2B market, Web 3.0 is a 2C market. RWA's products are standardized, and the trading ecosystem is more non-standard. At this time, the key to RWA's success is: How to realize the 2B market to the 2C market?This is also the elite with Web 3.0 attributes in the early stages of licensed and compliant exchanges. They are only optimistic about the retail market with more currency circles and look down on the traditional centralized institutional market. However, RWA inevitably means compromise and moderation. With education such as Bitcoin Spot ETF, more and more licensed and compliant exchanges, including native cryptocurrency exchanges, have begun to attach importance to RWA and institutional markets.Isn't that easy to understand: How does the institutional market transform into a retail market?a) TRS is the basis for arbitrage or transfer of bricks that is familiar to the currency circle. Institutional customers and retail investors have different capital costs and risk strategies, so there is naturally market space for interest rate swaps between institutions and retail investors;b) The traditional bond market is the private placement, distribution, issuance (wholesale) and secondary market (retail) of the institutional market. The retail retail market is at the end, and there is arbitrage space for wholesale and retail and priority and inferior ones. However, RWA tokenization is It is possible to achieve simultaneous admission of retail investors and institutions through different models such as NFT, airdrop, and mining, even based on the possibility of DAO community, DEX and AMM entering earlier than institutional customers;c) In the institutional market, there will inevitably be lock-ups, lock-ups, and cash shipments, or quantitative arbitrage. If cash is cleared, retail investors will take over the offer, and it does not rule out that institutions will gain the chips and liquidity of retail investors.Therefore, RWA products and trading ecosystems are basically in the form of assets and products familiar to financial institutions and funds, but uplink takes a new form and new liquidity of tokenization and virtual asset trading, especially the diversified secondary market (token trading market), which continues to attract more traditional financial institutions and old money.