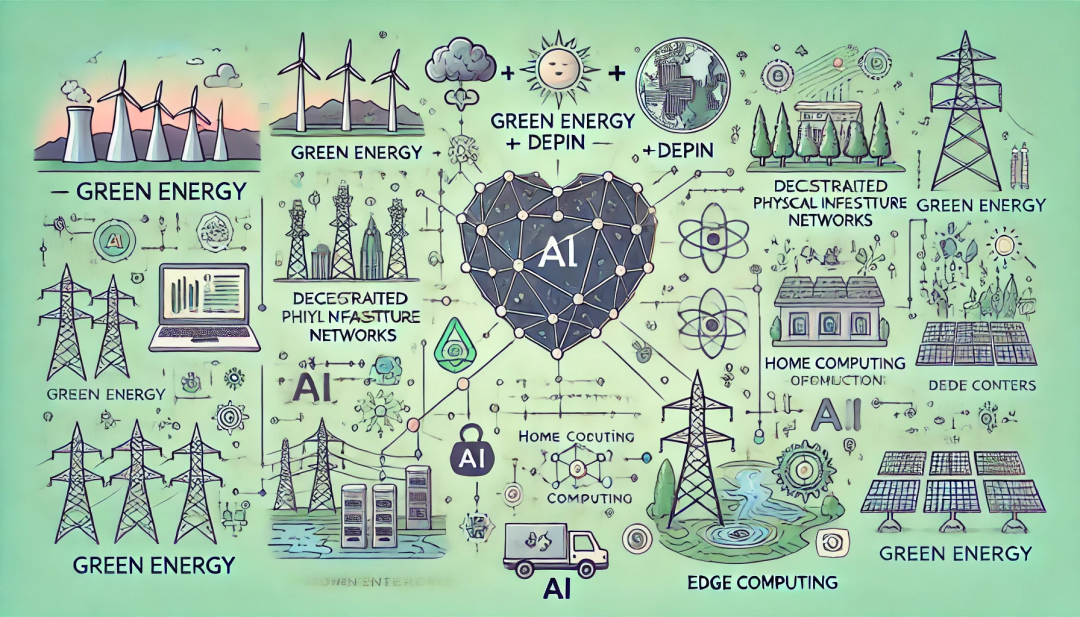

Why is "Green Power + DePIN+AI" the best asset of RWA?

scanning:429

author:

time:2024-09-10

Recently, bitcoin has become popular and overshadowed the heat wave of AI chips, but the green power behind the two is very low-key, and Kaige believes that this low-key emerging asset could become one of the fundamental assets of the financial system over the next two decades.The topic of renewable energy (or new energy) has not been around for a day or two, such as the global petrochemical energy transformation in the context of carbon emissions, the anchoring of petrodollars may be broken. Subsidies for local new energy in Europe and the United States and carbon taxes and tariffs on China's new energy equipment are key topics around green power.In May, the G7 member states jointly pledged to phase out the existing, unabated coal-fired power generation from the energy system by 2035; this summer is full of abnormal weather caused by high temperatures and floods. All of these topics are closely related to green electricity.Why the combination of "Green Power + DePIN+AI"?RWAAs the monetization of Tokenization of Real World Assets real-world assets, what are the basic assets of future real-world assets? There is no doubt that green electricity is one of them.In the discussion around the hot topics of AI, Musk andHuang RenxunIt is mentioned that the power consumption of AI computing power is huge, and the ultimate power of AI computing power may be green energy. In the field of AI, there is an unwritten inequality: green power > electric power > computing power > basic model > application. When the world entersAIGCIn the era of carbon-based and silicon-based, green electricity was one of the most critical foundations. Future assets and applications will almost always be related to AI, including AI computing power and AIGC, etc.; future energy and power will almost all be related to green power, renewable energy (photovoltaic, water, wind, etc.) and hydrogen energy, light storage and green power trading, and so on.As the basic asset of the real world in the future, the monetization of Green Power inevitably needs the support of DePIN and AI. In the combination of "Green Power + DePIN+AI", it is equivalent toAI added brain to the green electricity., andDePIN added heart and blood vessels to the green electricity.. Green power as a basic asset, but also the source of assets in the new real world and encrypted world, it is a natural scarcity and head narrative; DePIN is the ecological infrastructure and trusted equipment network of green power assets, realizing the distributed network, digitization and chainization of green power; AI is the core of fully highlighting green power to reduce costs and increase efficiency, whether it is AI green power arbitrage or household computing center and edge computing.Around the combination of "Green Power + DePIN+AI", there can be many changes, depending on the main body and the scene. For example, starting with photovoltaic energy storage, some people do distributed photovoltaic panels and green power vouchers and carbon indicators; some people do energy storage green block chain economy, and may only see green REC and carbon indicators supported by distributed accounts. Some people will see the BatteryGPT of battery life cycle management of energy storage, the DER demand forecast of reverse "power generation" of energy storage and the EnergyGPT of electricity price arbitrage, while others will see the investment model of integrated standard nodes for optical storage and utilization, as well as VPP virtual power grid and P2P green power trading that can be separated by walls. Well, Kai GE chose Energy "SaaS+AI" with energy storage as the center.DePIN soft heart of green electricity(1) distributed green energy smart storage networkThe biggest problem of Green Power is the distributed characteristics, except for some large single projects, most of them are small-scale, self-use and partial absorption, not necessarily enough to enter the network, and so on. However, with the EMS energy management function of energy storage, combined with DePIN technology and AI technology, it can be realized: "Green Power + EMS+DePIN+ AI = = Green Power Storage as a Service", that is,Green SaaS storage as a service.In the optical storage and charging system of green electricity, the single point digitization of the photovoltaic board module, energy storage module and charging pile module of the hardware equipment is already very high. For example, the BMS of the battery, the EMS of the electric energy, the PCS of the converter charge and discharge can be realized in the energy storage module, and even the control of the photovoltaic panel inverter of the photovoltaic module and the up and down control of the distribution network. The energy digitization and energy management equivalent to a single point module are 100% realized.The most important feature of the soft heart is that, on the basis of the digitization of a single point of hardware equipment, the distributed networking is realized based on DePIN technology, the Internet of things capability of DePIN and the computing power of the supporting chip AI, combined with Green Electric's AI Bot orAI AgentSo that green power can really become the infrastructure of distributed networkThe further soft heart is VPP and P2P. Based on the distributed network infrastructure, VPP can model virtual DePIN intelligent boxes and Internet of things devices (batteries, inverters or chargers, etc.) to achieve edge device prediction and control, obtain green energy telemetry data from millions of Internet of things devices and control actions such as charge and discharge, and achieve a distributed green energy storage service and green cloud.(2) "EVM" ecological closed loop of green electricity.From the point of view of the integrated charge and storage management of the energy source network, the ecological closed loop of green power will not be a single point module, such as photovoltaic or charging pile module, but from the generation of green power to storage and then to the consumption of charging power. In the green power SaaS storage service, there is one in and one out of green power, and there is a unique time and hash value of consumption.Complete Green Power Digital Asset cycle.For arithmetic assets, there is aGPU hourThe concept, as the unit of the arithmetic asset pool, and the green power assets, can have similarGWh green watt hourAs a unit of the green energy asset pool On the basis of distributed green power infrastructure, it will involveVirtual energy asset pool at the second tier (similar to Layer2). This involves the pooling of green power assets, asset dynamic pricing and liquidity, and first of all,Algorithm of putting Green Power assets into PoolThe confirmation and location of green power assets (distributed unique location address and confirmation) and coordinate the conditions of entering the pool (pledge into the pool or conditional access to the pool, or random time into the pool, etc.).From this point of view, the photovoltaic module and charging pile module are far less than the energy storage module which is an indispensable intermediate link in the ecological closed loop of green electricity. As a result, in the ecological framework design, Kai GE designed the second layer of green electricity into a"EVM" of Green Power assetsThe intelligent contracts, algorithm protocols, basic component services, etc., after the assets are pooled, will become an aggregation of distributed green power assets / resourcesOpen two-tier platform. For example, PPA intelligent contract of green power transaction, on this two-tier platform, PPA power purchase agreement can be similar to Ricardian contract mode to realize intelligent contract on the basis of current asset pool.(3) Green Power Trading NetworkWith the green power asset pool, combined with VPP (the network basis of transaction exchange), P2P green power trading can be realized. The key to green power trading is full marketization, so there areMulti-level market structure(capital side and asset side and diversified trading methods), there areDiversified market participants(green electricity buyers and sellers, liquidity LP, arbitrage speculators, standardization investors, etc.),Multi-angle flow pool and liquidity.Green power trading needs the full support of AI technology, whether it is the dynamic pricing algorithm of green power, the prediction of electricity price arbitrage, the optimal path of transaction allocation of green power resources, and the optimization of price curve of green power trading algorithm, etc., all need the deep support of EnergyGPT and time series AI model.In the mobile pool of green power trading, green power comes from different market participants or different sources, and the demand and timeliness of holders or sellers are different. there may also be 2B standardized optical storage nodes or large monomer optical storage and charging modules, there may also be a large number of distributed home optical storage and charging modules, and the grid power with peaks and troughs is also involved. as a result, the price of green electricity is not static or relatively fixed. But there is a dynamic,Decentralized Green Power pricing algorithmThis pricing algorithm, which builds consensus and trust in marketization, means the pricing power of green power. What does the pricing power of green electricity mean? Anyone in finance knows it.The transaction mode of green power transaction is different from that of market participants, and the coordination conditions of assets into the pool are also different, so the transaction is also very complex. Although there will be order-thin CEX, decentralized DEX and OTC transactions, but because of the asset pool algorithm and asset pricing algorithm, the core of green power trading is SWAP, which automatically optimizes the allocation of resources. This means the optimal configuration of the core green power transaction:Decentralized Green AMM transaction algorithm. Because green energy assets are dissipative, they may need to be similar toUniswapThe fixed product algorithm is modified and optimized.AI intelligent heart of green electricity(1) EnergyGPT and Family AI Computing CenterThe collision between AI and green electricity is very sparkling, and it is a high voltage spark. We cooperate with American university energy laboratories in EnergyGPT. There are a large number of application scenarios of Green Radio and TV University model around Green Power's electricity price arbitrage, peak cutting and valley filling, equipment attenuation cycle, thermal out of control of energy storage battery, DER demand forecasting, power load forecasting, charging and discharging active strategy and so on. This EnergyGPT is different from the traditional LLM model, and it is not the traditional time series prediction model. It is a mixed MoE expert model.Because the DePIN intelligent box based on the green power distributed network can configure part of the GPU computing power to forecast the local electricity price demand and calculate the optimal arbitrage charge and discharge strategy, as well as the local rendering calculation of home film and television entertainment games, at the same time, it can also cooperate with the regional center to do some edge computing tasks.The standardized optical storage node can be configured as a regional AI computing center, and a certain scale of AI chip computing power can be configured on the basis of the energy storage cabinet to carry out regional demand forecasting, electricity price arbitrage, peak cutting and valley filling, charging and discharge strategies, as well as regional AI computing tasks, and can be used as regional nodes for edge computing.Green power EnergyGPT and AI computing basically appear in the way of AI Agent or AI Bot on the user side. Each 2B small and medium-sized enterprise or standardized node and 2C family have different needs, so they need to configure green power AI mode intelligently, and even open up more application scenarios.On the basis of VPP and regional standardized optical storage nodes, distributed AI nodes expand into regional AI computing nodes and become distributed AI computing nodes and edge computing nodes.Limited to space, this part of AI will not be carried out too much, and we will have the opportunity to talk in detail at the symposium.The New Financial system of Green Power(1) Standard investment modelThere is a standardized product in green electricity ecology, that is,Green electric-optical storage and charging integrated charging stationGenerally, photovoltaic energy storage around 300KWh and energy storage around 200KWh plus matching charging piles and parking spaces, some AI chips are configured in the energy storage module to increase AI computing power, and become a typical AI standard node for green electro-optic storage. This standard node can accurately evaluate and calculate the overall input, actual output and investment return cycle, which is equivalent to a standard investment model. Its main revenue comes from the charging consumption of green power, the dynamic balance subsidy of the power grid, the income from peak cutting, valley filling and electricity price arbitrage, as well as the income from cloud rendering, cloud computing power and edge computing tasks of regional AI computing power. A node of a standard investment model can be designed as aFixed collection RWAThe product is fine.Compared with the standardized optical storage and charging AI node, the green electricity household investment model is a non-standard product, because there are great differences in household size and power consumption patterns in Europe and the United States, some families are equivalent to small industrial and commercial savings, and some families are simple household self-use models, so it is difficult to form a standard green electricity household investment model. However, the green household investment model will have more charging application scenarios, which will be very fun: "roof photovoltaic + household storage + new energy vehicles + household AI computing center + robot / VR/ games and so on."(2) RWA Product Agreement of Green PowerIn addition to the previous standard investment model node, the RWA product design of Green Power mainly depends on the optical storage and charging module in the green electricity ecology.Operating cash flow. If you look at it from this point of view, the most obvious thing at present is the charging pile business.Charging pile operatorCharging charges can be charged directly (2C), including electricity and service charges; it is equivalent to green electricity consumption; however, in terms of scale and stability, the future will beEnergy storage operatorHowever, at present, most of the energy storage is OEM, and it has not yet gone to independent operators. Brand energy storage operators will charge monthly service fees from owners (2B organizations or 2C household storage). This is a relatively stable operating cash flow and is easier to expand.At this stage, the photovoltaic panel module is often the role of spare parts, most of the photovoltaic green power is self-consumption, rarely sold, basically can not be regarded as operating cash flow.In the process of green power RWA, DePIN, as one of the infrastructure of green power RWA monetization, tamps the transparency of green power assets and values; at the same time, because green power assets are pooled and traded through DePIN smart boxes, DePIN loads RWA token cash flow. In this way, RWA becomes the feedback loop of green power DePIN flywheel and the endogenous value thruster of green power distributed network.Green RWA token cash flow is often the income of producers and consumers, such as electricity price arbitrage, demand response, handling fees of green electricity transactions, management fees of green power flow pool, zero price difference between carbon credit and green electricity vouchers, and so on.(3) Green Power RWA product innovation.RWA product innovation of Green Electric Ecology must be based on the core algorithm protocol Protocolization. That is,Three core algorithmsDecentralized green power asset pool algorithm protocol, decentralized green power asset pricing algorithm protocol, decentralized green power transaction algorithm protocol.With this basis, we can design RWA products related to green power, such as green debt, fixed collection products; green ABS, diversified income products or cash distribution products; this is a relatively basic RWA product, which can be understood as "US debt" and high-quality "corporate debt" similar to Green Power.On the basis of these assets such as Green Power US debt, we can further innovate and design green power related RWA products, such as loan products based on Green Power "US debt" assets, futures options products, electricity price or power insurance products, as well as further green power stability coins, green power ETF index products.There can also be an attempt, in addition to Bitcoin mine mining on the basis of network electricity combined with green electricity, green electricity dug out with green bitcoin, and whether the regional optical storage AI node can be configured with bitcoin mining machine, which can be used for bitcoin mining with suitable cost after cutting peaks and filling valleys. This model is a "Green Power + Bitcoin Computing" RWA product.Around the new ecology of Green Power, in fact, there are many projects in Europe and the United States, such as MicroGrid, P2P electric trading and Renewable Power Coin, which are already exploring the monetization and P2P transactions of Green Power. Even Hong Kong, which has an inch of land and money, already has a microgrid with 600000 photovoltaic units connected. 80% of the largest manufacturing capacity of the global optical storage and charging industry is in China. Therefore, green power is the core opportunity for China, but AI computing is banned by the United States, the domestic energy market is not fully market-oriented, and the superstructure of the optical storage and charging industry is not in China. We only have the hardware capacity of green power, but we do not have the soft heart and brain of green power, as well as pricing and trading rights.

New Green Power Financial ecosystemTo sum up, green power is not only the best asset of RWA, it is actually a new ecosystem. Green electricity combines DePIN, AI and RWA to form a huge virtual green energy pool, transaction exchange and new financial system.At present, there are still opportunities, because China still has an advantage in hardware production capacity, and the green electric storage industry does not have a suitable valuation system in the traditional financial system, under the premise of decoupling between China and the United States and containment in Europe and the United States, based on the traditional cost method or income method, it is difficult to have a reasonable valuation of green electric storage and charging. But in the RWA system, Green Electric combines the hot spots and concepts of DePIN, AI and RWA, the optical storage equipment nodes, installed capacity and so on in the real world, which can be transformed into the high premium advantage of the digital assets track leader.But what is more urgent is that the soft infrastructure and basic research around green power trading, such as SaaS cloud energy management, EnergyGPT, energy blockchain, green power vouchers and carbon credits, P2P exchanges, and related green power asset agreements, PPA intelligent contracts, decentralized pricing algorithms, P2P trading algorithms and green power financial derivative Defi protocols, etc., are also ahead of Europe and the United States. Bitcoin power and AI power are also dominated by Europe and the United States. Even the basis of the RWA system, around the public chain, Layer2, green electricity stable currency and so on, is dominated by Europe and the United States.We must realize that this new ecology of green electricity will be a new valuation system, a new incentive system, a new trading system, a new monetary system, and a new financial system.Green power in the real world is the core energy of the future, and bitcoin, the core asset of the encrypted world, is bound to be linked to the narrative of green computing power. If Bitcoin or green Bitcoin is used as a reserve asset in the United States and around the world, then official institutions, financial institutions and large amounts of money will hype Bitcoin, Green Power and AI.Kaige has been engaged in real estate finance for many years. Looking at the underlying financial support in the past two decades, the financial support has almost been "land + real estate", and the outlookThe underlying financial support in the next two decades will surely be "green electricity + computing power (Bitcoin computing power +AI computing power)".In the future, the decisive battle between China and the United States will be between green power and computing power. The decisive battle between green power is not hardware production capacity, but green power's soft-heart computing power, system large-scale model capabilities, pricing capabilities and derivatives capabilities. Therefore, our green electricity must be transformed from hard to soft, and we can no longer continue to manufacture and manufacture again and again!Finally, we are jointly establishing an Asian RWA professional investment banking company to provide diversified RWA investment banking services for high-quality assets and entrepreneurs. Interested institutions and potential partners are welcome to participate in the construction; we also welcome WeChat YekaiMeta to join the RWA practice seminar group to participate in the discussion.