The problem with Hong Kong's Web3.0: people in SFC and traditional finance are a little afraid or despise if they don't understand Web3. People in Web3, who are not interested in traditional financial and institutional markets, think that Web3 should be a decentralized innovation around retail investors (leeks) and despise conservative institutional investors. But at present, the old channels, PI and old money are all familiar with the old guns of traditional finance. If we can go against each other and strengthen promotion and integration, Hong Kong's Web3.0 will go further.Around the virtual asset exchange, in addition to the issue of the number of licenses and rules, there is also a licensed exchange that is the only one that guarantees everything. Hong Kong as Web2.5RWARWA exchanges cannot be both referees and athletes, because the ecology of corporate financing and financial assets trading requires a specialized market, in which professionalism, risk control and balance require professional institutions and third-party services, rather than just relying on a virtual asset exchange.This means that investment bankers in Central have a completely new place to go, the real-world asset monetization and the ecological market it brings. Moreover, this place may be the talent that Europe and the United States are competing for in the future, because in terms of STO/RWA compliance and related infrastructure such as exchanges, Hong Kong is in the forefront of the world, and Hong Kong has no shortage of traditional European and American financial talents.Although it is Web2.5, it cannot be improved or gradually revolutionized only by relying on traditional financial institutions. The early days of RWA look very similar to traditional financial products, but its uplift around blockchain and tokenization is innovative, and the next stage of RWA products will show more innovations of native tokens and encrypted financial Lego. Therefore, it requires a group of people with lofty ideals to try and innovate RWA's encrypted investment banks, start the investment and research of related assets and tracks in the early stage of RWA, tokenize transactions, and quantify encryption funds.Market makerAnd so on, become the mainstay of promoting the development of RWA.RWAEncrypted investment bankCompared with the traditional financial market securities firms and investment banks, RWA as a real-world asset monetization, the symbol of its mature development is the emergence of professional, independent RWA encryption investment banks. These RWA encryption investment banks will have strong RWA track (including real-world assets / industry) brand operation and management capabilities, raise and withdraw RWA assets through encryption Industry Capital (Crypto RWA Fund) in investment banking mode, raise Crypto Fund specializing in RWA, invest in incubating RWA-related track enterprises (RWA assets), issue RWA products, continue operating equity distribution and brand building to achieve RWA premium. Continue to acquire real-world assets to expand RWA or issue new RWA products, cash out and continue to invest. In the fund-raising and investment management of RWA assets, you can also design your own Token model (original tokens) based on brand IP or asset governance, equity release and other angles.In traditional financial institutions, there are mainly three types of investment banks' roles: first, securities firms, such as Hong Kong securities firms, who apply for No. 1 license uplift this time, can participate in RWA product issuance and brokerage underwriting; second, investment banks such as Goldman Sachs and Morgan Morgan, in addition to simple debt, RWA can also be a digital IPO for equity listing, because IPO investment banking business can also be used for reference. The third is industrial capital, which is fully and deeply involved in a certain industry, such as commercial real estate Cade and logistics warehousing.The most significant and typical ones for RWA are Cade and GLP in traditional industry investment banks. Cade in commercial real estate, GLP in logistics warehousing, have strong brand operation and management capabilities, through the industrial capital investment banking model to achieve investment management withdrawal, stage-by-stage layout: private equity funds + industrial management and operation + IPO+REITs, forming a capital cycle. For example, Cade has dozens of private equity funds (Fund), corresponding to different stages of asset packages and releasing some equity / shares to insurance funds, pension funds, etc.; there are two Singapore listed companies: Cade Group and Cade Investment; there are six Singapore REITs publicly listed and traded. Both listed companies and REITs can issue additional mergers and acquisitions as one of the exit channels of assets, or assets can be listed separately. Even if it is the adjustment of asset allocation strategy, there are very flexible operation methods. For example, after Cade packaged six domestic Raffles projects in 2021, he released part of his equity to Ping an Insurance to realize the withdrawal of more than 30 billion cash, and then made large-scale mergers and acquisitions of new digital economy assets such as data centers in first-tier cities.Zhi Merchants Institute +Four major grain merchantsMode ofThere is also a special reference for RWA. "Zhi Merchants Institute + four major grain merchants "The cooperation mode of industrial investment banks.For example, core agricultural productsSoybean industryThe industrial capital of international grain merchants, represented by the four major multinational grain merchants "A, B, C, D", makes full use of the pricing power of futures trading in Chicago, as well as Wall Street.Financial derivativesAnd the capital market, relying on the strong support of the capital market and the abundant financing of banks in various countries, manipulate the price to suppress the soybean industry, take advantage of low capital acquisition, raise prices after monopolizing the industry, promote the procurement of genetically modified soybeans, and completely control China's soybean industry.China, originally the birthplace of soybeans, has always been the country with the highest soybean production in the world, but now China has become the largest importer of soybeans. In just a few decades, 60% of the total global soybean output has been exported to the Chinese market. However, domestic soybean farmers are growing less and less, and the whole soybean industry chain has been controlled by the capital of international grain merchants.How does the industrial capital of international grain merchants cooperate with the exchange to achieve industrial control?In the mid-1990s, China basically did not need to import soybeans; in 2001, China opened its soybean market and foreign investment continued to pour in. At this time, through the Chicago Stock Exchange, the four major ABCD grain merchants control 73 per cent of the world's grain trading, and they manipulate the price of CBOT soybean futures, which is the benchmark for international soybean trade, based on production, supply and demand market information spread all over the world.In 2002, 2003 and 2004, multinational grain merchants and Wall Street speculators set up against Chinese soybean crushing enterprises in the international futures market three times in a row. "Force the warehouseIn 2003, soybean prices skyrocketed and Chinese soybean processing enterprises had high purchasing reserves; in 2004, soybean prices plummeted, and after being frantically suppressed by international investment funds, Chinese soybean crushing enterprises were almost wiped out. The capital of the four major grain companies entered on a large scale through low-cost expansion such as equity participation, holding and acquisition, and successfully controlled 85% of the actual processing capacity of China's soybean.After controlling the processing process, international grain merchant capital began to lock in soybean sources and import soybeans from the areas they controlled; foreign oil crushing enterprises began to buy only GM soybeans, while 90% of GM soybean seeds and pesticides came from Monsanto; international grain merchant capital in the planting areas (Latin America), using contract planting + providing loans + seed fertilizer agrochemical, indirectly control the planting link.The four major grain merchants have begun to control the pricing power of edible oil, and have controlled more than 75% of the raw materials and processing of China's oil market and the supply of edible oil. among China's 97 large oil enterprises, multinational grain merchants have taken a controlling stake, relying on international capital. has basically completed the absolute control over the upper, middle and lower reaches.In 2011 and later, China imported more than 80% of soybeans, gradually accounting for 1% of the world's total imports. So far, the big four grain manufacturers that control 90% of the world's soybean trade have also monopolized 80% of China's imported soybean supplies after controlling more than 60% of China's actual crushing capacity.The industrial capital of these international grain merchants buys cheap soybeans from South America and soybeans with huge agricultural subsidies from the United States, which are then resold to crushers in China at high prices to make monopoly trade profits. "South American soybeans, Chinese buy soybeans, Americans sell soybeans and determine prices" is a true portrayal of the soybean industry.The case of soybean industry urges us to understand the power of industrial investment banking model. Based on the commodity grain dollar (international trade dollar settlement), the big four grain merchants carry out the global layout of the whole industry chain, controlling 80% of the world's grain trading volume and market information data. at the same time, it also adopts a two-pronged approach in the financial fields such as spot and futures trading of global agricultural products, and jointly participates in financial transactions with capital markets that control pricing power. Finally, the strategy of "trading-futures-finance-capital-whole industry chain" will be continuously upgraded.RWAThe business of digital investment bankFrom a name point of view, it's calledEncrypted investment bankOrDigital investment bankMore catchy?Generally speaking, the core of the development of RWA ecology is that for the asset side, the capital side, and the institutional clients, RWA should be able to combine tokenization, virtual asset exchanges and intelligent contracts to provide them with incremental income, that is, what is not or cannot be realized in traditional financing, so that it can continue to grow and promote the expansion and maturity of RWA ecology, which happens to be the existence value of RWA digital investment banks.

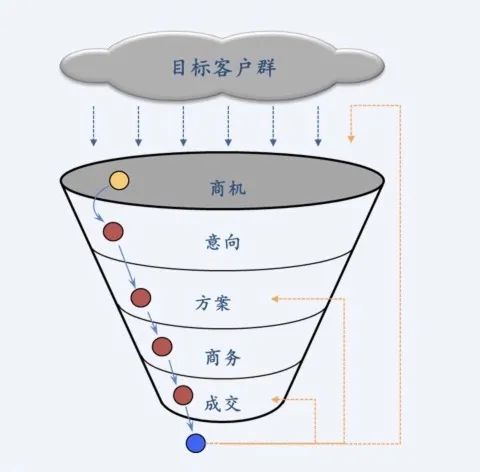

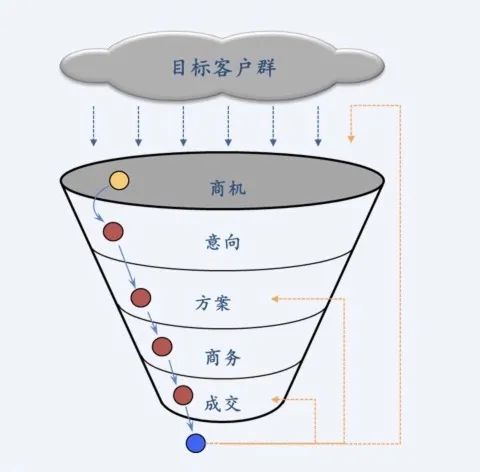

The 2B market, which revolves around the ecology of corporate financing services, is a big funnel. The positioning of RWA digital investment bank is very critical. We should not just focus on that part of the currency issue, but that part is the core concern of the exchange, the funnel of financing from the entire encryption company.

Publicity and education of the early target customer base, as well as related meetings, investment and financing courses, etc.

Then to the professional research report and track depth analysis.

Then there is the discussion and exchange of the specific asset monetization scheme of the intended enterprise.

Then to the roadshow and communication of channels and sources of funding that are interested in RWA assets and products

Further to the specific tokenization tutoring and investment business.

Finally, in addition to the currency, there is also the quantification of the secondary market and market-making and so on.RWA digital investment bank, must beCross-border modeTalents and business models are cross-border, and you need to have the experience of traditional financial and encrypted assets and Web3.0. Without crossing boundaries, it is difficult for you to coordinate and run-in the synergy between 2.0 and even 1.0 and 3.0.RWA digital investment bank, but also haveChannels for traditional securities firms or investment banksFamiliar with the traditional institutional market, so that we can quickly start with the new product promotion test on the basis of the traditional channel and institutional market, and then constantly promote its uplift to become the vanguard of RWA asset monetization track.RWA digital investment bankTutoring, incubation and patronageAnd other functions, is currently relatively lacking and urgently needed, can not only rely on licensed exchanges, licensed securities firms may also be limited by traditional shackles, there is no real innovation of digital investment banks, RWA will always compromise and malaise.Of course, there will be many new ways to play Web3.0, and so will RWA, such as forMonetization of cash flowDesign, forLiquidityFor those based on RWA assetsOriginal tokenAndEncrypted Finance LegoThe design is a very good direction, and it is also the core magic weapon of the future RWA digital investment bank.At present, it is necessary to cultivate or build an influential and consensus RWA digital investment bank as a banner.Just like the traditional stock market investment, it usually looks at the investment and research report of CICC, which is made up of nearly a thousand investment and research centers and relevant research personnel. If RWA products become rich, then RWA encryption of the "stock market" also needs a digital "CICC".